Social Security Earnings Limit 2025 Increase. The individual tax brackets for ordinary. Additionally, the earnings threshold for.

The maximum amount of earnings subject to social security tax (taxable maximum) will increase to $176,100 from $168,600. The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings.

Social Security Limit 2025 Increase Riley Aziza, The social security administration (ssa) has unveiled the updated thresholds and benefits for social security disability insurance (ssdi) for 2025.

Social Security Maximum Taxable Earnings 2025 Phebe Carmina, What is the new taxable earnings limit for 2025?

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

2025 Max Social Security Tax By Year 2025 Rowan Khadija, The taxable earnings cap for social security is the maximum income amount subject to social security taxes.

Social Security Max Taxable Earnings 2025 Lok James Saif, The social security administration (ssa) has unveiled the updated thresholds and benefits for social security disability insurance (ssdi) for 2025.

Social Security Tax Limit 2025 Increase Mariam Grace, Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Social Security Limit 2025 Increase Riley Aziza, The taxable earnings cap for social security is the maximum income amount subject to social security taxes.

Social Security Limit 2025 Increase Riley Aziza, The taxable earnings cap for social security is the maximum income amount subject to social security taxes.

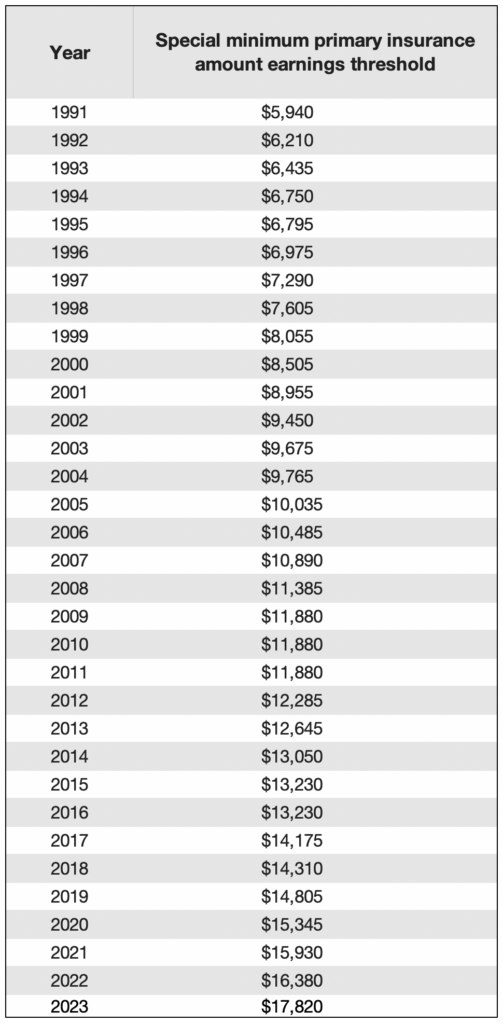

What is the Minimum Social Security Benefit? Social Security Intelligence, This amount is also commonly referred to as the.

Social Security Checks To Get Big Increase In 2019 Social security, The individual tax brackets for ordinary.

Social Security Limit 2025 Increase Clara Layla, In 2025, 2025, and 2025, beneficiaries enjoyed respective increases to their social security checks of 5.9%, 8.7%, and 3.2%.