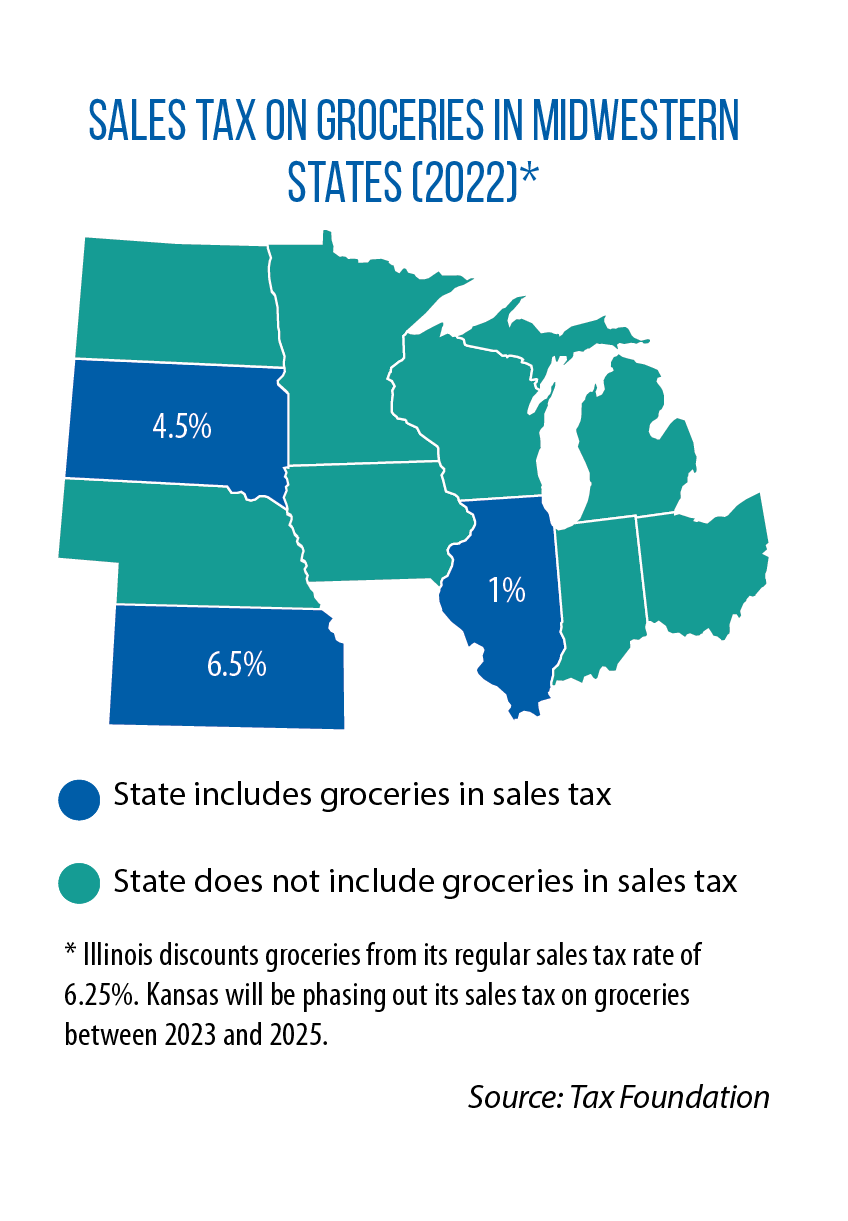

Grocery Tax By State 2025. Stitt will sign a grocery tax cut bill, even before an income tax cut bill. An additional 1% would follow if revenues into the etf.

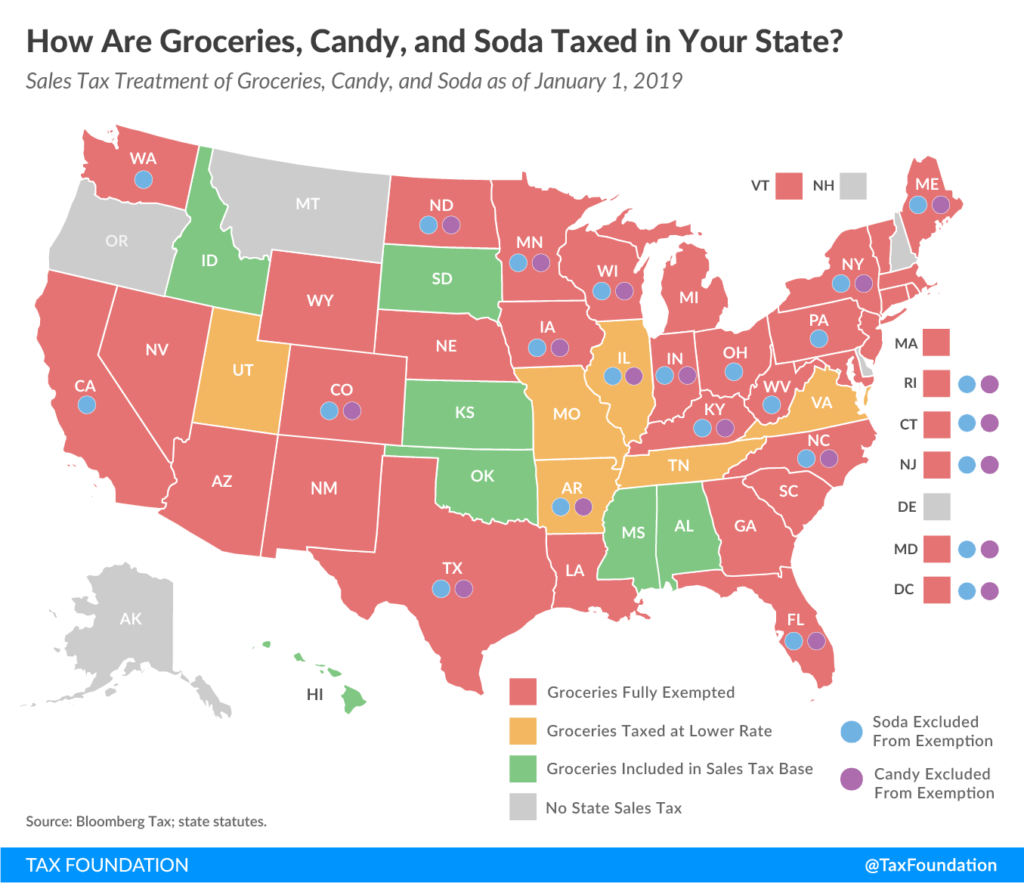

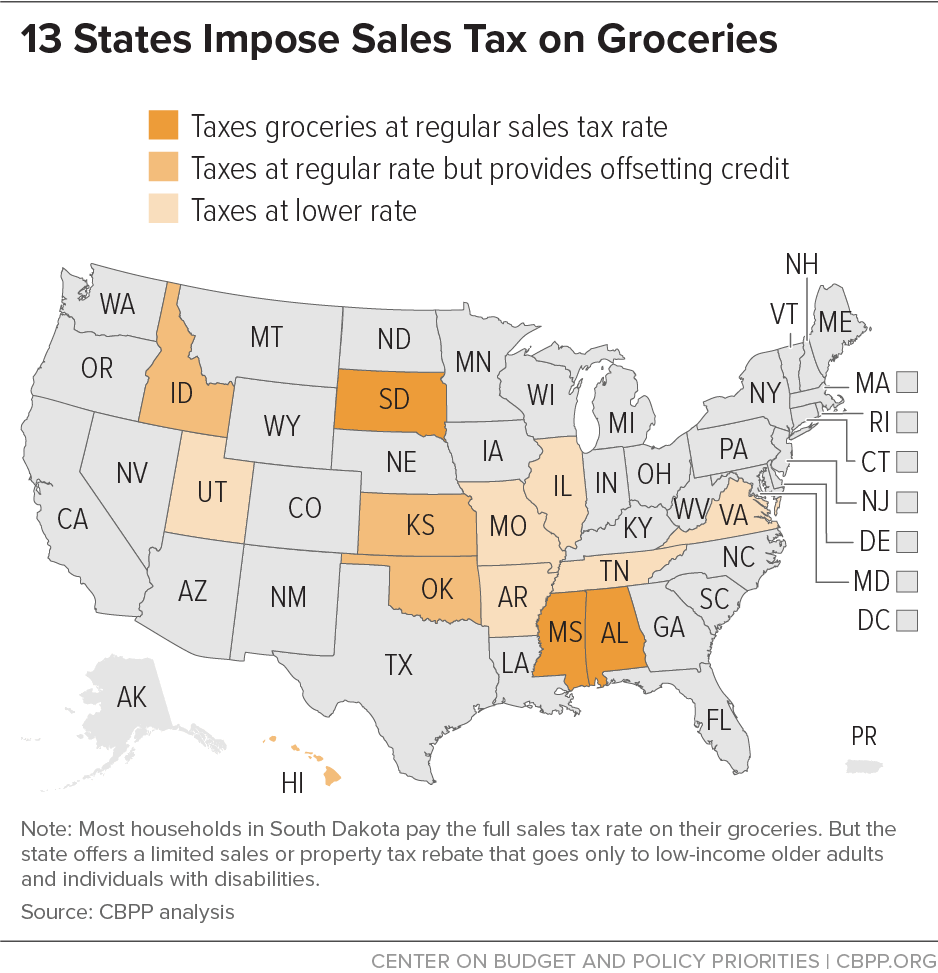

The commission said revenues for grocery retailers were 6% over total costs in 2025, and 7% in the first nine months of 2025, higher than a peak of. Of the 11 states that still impose a tax on groceries, two do so at the full state sales tax rate, and the rest offer a lower tax rate for groceries than the.

Sales Tax on Grocery Items by State Chart, 27, 2025 at 9:00 am. He joined the station in january 2025.

States Can Thoughtfully Implement Grocery Tax Reforms to Help Families, What grocery tax cut opponents aren’t telling you is that local governments in illinois have seen a dramatic increase in funding from state. The bill, which passed with.

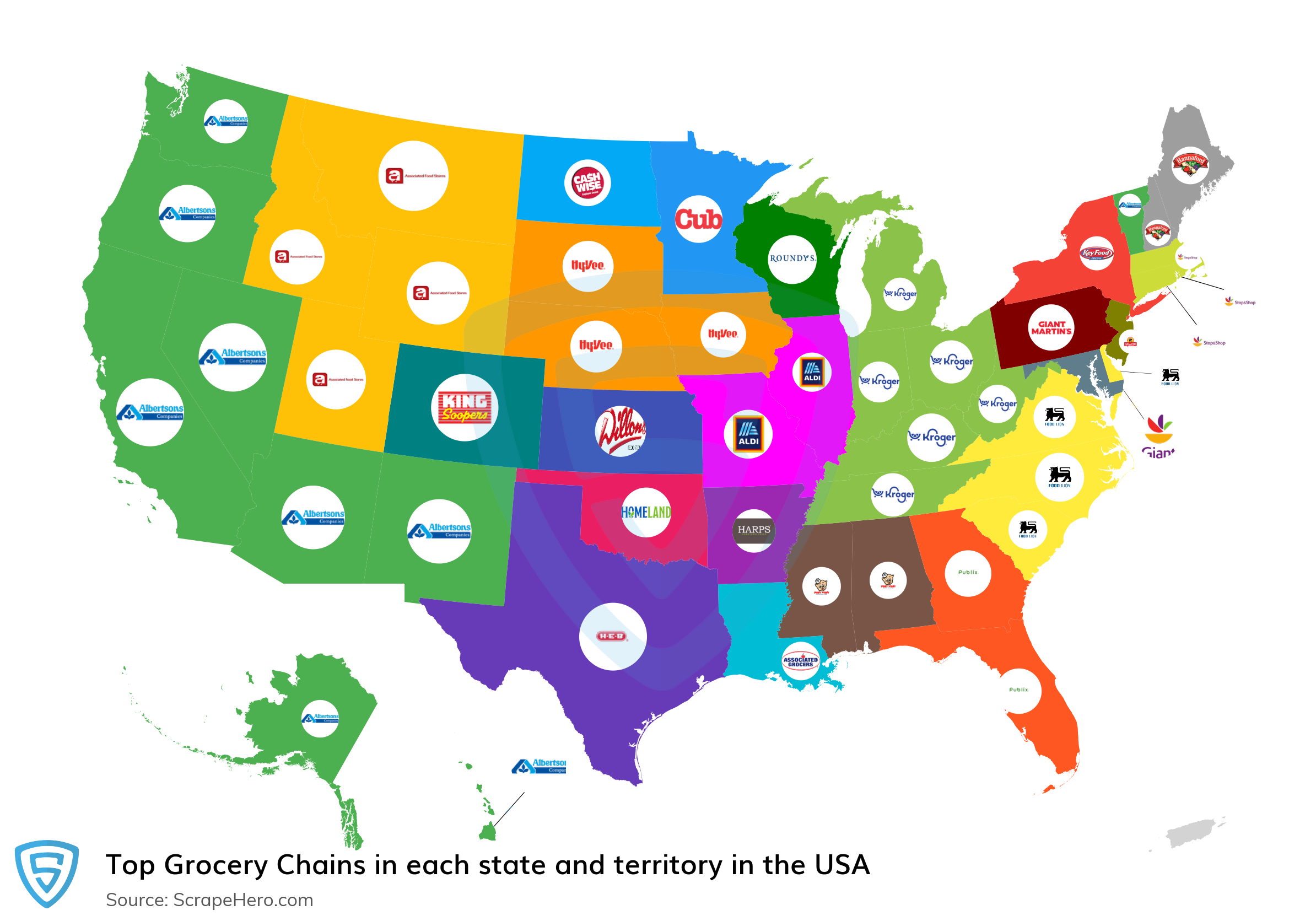

10 Largest grocery chains in the United States in 2025 ScrapeHero, According to the usda, grocery prices are up 1.2% in january 2025 compared to the same time last year. Pritzker proposes eliminating sales tax on groceries, mayors worry about revenue loss.

Ranking Of State Tax Rates INCOBEMAN, Feb 27, 2025 / 12:20 pm cst. Of the 11 states that still impose a tax on groceries, two do so at the full state sales tax rate, and the rest offer a lower tax rate for groceries than the.

Monday Map Combined State and Local Sales Tax Rates, Pritzker’s proposal to eliminate a state sales tax on. After years of discussion and.

.png)

USDA ERS Chart Detail, 1, the state sales tax on grocery food will drop from 4% to 2%. He joined the station in january 2025.

Taxes By State 2025 Dani Michaelina, A cut to oklahoma’s grocery tax has been widely praised. Of the 13 states that tax grocery purchases, more than half have.

State Sales Tax on Groceries FF (09.20.2025) Tax Policy Center, Illinois shoppers would save a dollar when they buy $100 worth of groceries under gov. (wsmv) by justin allen rose.

Axe on grocery tax coming soon to Kansas; Illinois adopts temporary, The oecd on average raised 5.4 percent of total tax revenue from property taxes, compared to 10.4 percent in the united states. The law ends the state grocery tax and blocks increases in local sales and excise taxes on food through june 2025.